|

Understanding Dividends. When Are Dividends Paid?. Which Stocks Pay Dividends?. Common Stock Dividends vs Preferred Stock Dividends. What Is Dividend Yield?. How Are Dividends Taxed?. How Do Dividend Reinvestment Plans Work?. Dividends for Mutual Funds and ETFs. How to Calculate Dividend Yield. How Are Qualified Dividends Taxed?. How Are Ordinary Dividends Taxed?. . Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evalua Show

Top 1: What Are Dividends? How Do They Work? – Forbes AdvisorAuthor: forbes.com - 114 Rating

Description: Understanding Dividends. When Are Dividends Paid?. Which Stocks Pay Dividends?. Common Stock Dividends vs Preferred Stock Dividends. What Is Dividend Yield?. How Are Dividends Taxed?. How Do Dividend Reinvestment Plans Work?. Dividends for Mutual Funds and ETFs. How to Calculate Dividend Yield. How Are Qualified Dividends Taxed?. How Are Ordinary Dividends Taxed? Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evalua

Matching search results: WebNov 11, 2021 · A dividend is a payment in cash or stock that public companies distribute to their shareholders. Income investors prefer to earn a steady stream of income from dividends without needing to sell ... ...

Top 2: What are Dividends and How Do They Work? | IG UKAuthor: ig.com - 135 Rating

Description: Why do companies pay. dividends?. How do dividends affect share prices?. What is dividend yield?. Dividends and compounding wealth. How do dividends work in the UK?. Important dates for dividends. Dividends when investing. Dividends when trading What are dividends?Dividends are a portion of a company’s profit that it chooses to return to its shareholders. They are one of the ways a shareholder can earn money from an investment without having to sell shares. Dividends are paid according to how mu

Matching search results: WebNov 12, 2021 · Learn more about dividends and how they work. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. ... For example, if a company with a stock worth £5.00 is paying an annual dividend of 20p, the dividend yield is 4% (20p/£5.00). Investors should always compare the dividend yield of ... ...

Top 3: What Are Stock Appreciation Rights (SARs), and How Do They Work?Author: investopedia.com - 108 Rating

Description: What Are Stock Appreciation Rights? . Understanding Stock Appreciation Rights . Special Considerations . Advantages and Disadvantages of SARs . Example of Stock Appreciation Rights What Are Stock Appreciation Rights? Stock appreciation rights (SARs) are a type of employee compensation. linked to the company's stock price during a predetermined period. SARs are profitable for employees when the company's stock price rises, which makes them similar to employee stock options (ESOs). H

Matching search results: WebJun 27, 2022 · Stock Appreciation Right - SAR: A stock appreciation right (SAR) is a bonus given to employees that is equal to the appreciation of company stock over an established time period. Similar to ... ...

Top 4: About Form W-9, Request for Taxpayer Identification Number and ...Author: irs.gov - 111 Rating

Description: Other Items You May Find Useful EnglishEspañol中文 (简体)中文 (繁體)한국어РусскийTiếng ViệtKreyòl ayisyenUse Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example:Income paid to you. Real estate. transactions. Mortgage interest you paid. Acquisition or abandonment of secured property. Cancellation of debt.Contributions you made to an IRA.Current RevisionRecent DevelopmentsPu

Matching search results: WebSep 26, 2022 · About Form 1099-DIV, Dividends and Distributions. About Form 1099-INT, Interest Income . About Form 1099-K, Payment Card and Third Party Network Transactions . About Form 1099-MISC, Miscellaneous Income . About Form 1099-S, Proceeds from Real Estate Transactions . ...

Top 5: Dividends: Definition in Stocks and How Payments Work - InvestopediaAuthor: investopedia.com - 117 Rating

Description: What Is a Dividend? . Understanding Dividends . Dividend-Paying Companies . Important Dividend. Dates . How Do Dividends Affect a Stock's Share Price? . Why Do Companies Pay Dividends? . Are Dividends Irrelevant? . How to Buy Dividend-Paying Investments . How Often Are Dividends Distributed to Shareholders?. What Is an Example of a Dividend?. Why Are Dividends Important? What Is a Dividend? A dividend is the distribution of a company's earnings to its shareholders and is. deter

Matching search results: WebJun 28, 2022 · Dividend: A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, paid to a class of its shareholders. Dividends can be issued as cash payments, as ... ...

Top 6: Stock Trading | How to Trade Stocks | Capital.comAuthor: capital.com - 81 Rating

Description: What is stock trading?. How do stock exchanges work?. What moves. stock prices?. What is a stock trading strategy?. Different ways to trade stocks: retail trader edition. Pros and cons of trading stock CFDs. Why trade stock CFDs with Capital.com?. Stock market trading hours. Difference between stocks and shares. Different types of stocks. Types of stock trading strategies . Risk-management tools when trading stocks. Is stock trading a good idea?. How does stock trading work?. How do I start trading stocks?. How old do. you have to be to trade stocks?. When is the best time to trade stocks?. News. trading strategy. End-of-day trading strategy. Swing trading strategy. Trend trading strategy. Scalping trading strategy. Position trading strategy.

Matching search results: WebStock trading hours vary depending on the exchange a stock is listed on. Each stock market has set trading hours. For instance, if you want to trade shares in Barclays on the London Stock Exchange (LSE) you could do so between 08:15 to 16:30 (GMT) Monday to Friday. The LSE does not close for lunch, but most Asian stock markets do. ...

Top 7: What Are Stocks And How Do They Work? – Forbes AdvisorAuthor: forbes.com - 113 Rating

Description: Stocks and Initial Public Offerings. What Are the Different Types of Stock?. The Difference Between Stocks and. Bonds. Common Stock vs Preferred Stock. Different Classes of Stock Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. Stocks are units of ownership in a company, also known as shares of stock or equities. When you buy a share of stock, you’re purchasing a partial ownership stake in a company, entit

Matching search results: WebSep 20, 2021 · Holders of preferred stock have a priority claim to dividends, ahead of common stock shareholders. Regardless of the type of stock you own, the principles governing dividends are essentially the same. ...

Top 8: Best Growth Stocks to Buy in December 2022 | The Motley FoolAuthor: fool.com - 134 Rating

Description: Investing in Growth Stocks. What is a growth stock?. How to find growth stocks. Identify trends and the companies driving them. Prioritize companies with competitive advantages. Related investing topics. Find companies with large addressable markets. Expert Q&A on Growth Stocks Investing in Growth Stocks By Adam Levy – Updated Dec 19, 2022 at 2:41PM Investing in growth stocks can be a great way to earn life-changing wealth in the stock market. The key, of course, is to know which growth stocks

Matching search results: WebDec 19, 2022 · Investing in growth stocks can be a great way to earn life-changing wealth in the stock market. The key, of course, is to know which growth stocks to buy -- and when. Many growth stocks have been ... ...

Top 9: What Are Dividends & How Do They Work in Canada | WealthsimpleAuthor: wealthsimple.com - 121 Rating

Description: Forms of dividend payments. Advantages of dividend stocks. Criticism of dividends. Why dividend dates matter When you buy shares of stock of a company, you’re betting that your investment will appreciate and you will be compensated when you sell the stock. The idea is that you lend the company money by purchasing stock shares and you get rewarded for it.Let’s look at the definition of a dividend and what role it plays in investing.Wealthsimple Invest is an automated way. to grow your money like

Matching search results: WebMay 24, 2022 · Most companies pay dividends in one of several ways: Cash dividends: Companies who pay out dividends in cash based on the amount per share. For example, a stock may pay a quarterly dividend of $5 per share. This means someone who owns 100 shares of the stock can expect a dividend payout of $500 every quarter ($5 x 100 shares … ...

Top 10: Stock Dividend: What It Is and How It Works, With ExampleAuthor: investopedia.com - 111 Rating

Description: What Is a Stock Dividend? . How a Stock Dividend Works . . Advantages and Disadvantages of Stock Dividends . Journal Entry: Small and Large Stock Dividends . What Is an Example of a Stock Dividend?. Why Do Companies Issue Stock Dividends?. What Is the Difference Between a Stock Dividend and a Cash Dividend?. Is a Stock. Dividend a Good or Bad Thing?. What Is a. Good Dividend Yield?. Pros and Cons for Companies and Investors. Small Stock Dividend Accounting Large Stock Dividend Accounting .

Matching search results: A stock dividend is a payment to shareholders that consists of additional shares rather than cash. The distributions are paid in fractions per existing ...What Is a Stock Dividend? · How It Works · Dilution Effect · Pros and ConsStock dividends: 250,000Account: DebitA stock dividend is a payment to shareholders that consists of additional shares rather than cash. The distributions are paid in fractions per existing ...What Is a Stock Dividend? · How It Works · Dilution Effect · Pros and ConsStock dividends: 250,000Account: Debit ...

Top 11: When Are Stock Dividends Paid Out and How? - InvestopediaAuthor: investopedia.com - 150 Rating

Description: How Dividends Are Paid Out . Key Dividend Dates . Dividend Reinvestment Plan (DRIP) . How And Why Do Companies Pay Dividends? If a company has excess earnings and. decides to pay a dividend to common shareholders, then an amount is declared, in addition to the date when this amount will be paid out to the shareholders. Usually, both the date and the amount is determined on a quarterly basis, after a company finalizes its income statement and the board of directors meets to rev

Matching search results: A dividend is usually declared quarterly after a company finalizes its income statement and dividends are paid either by check or in additional shares of ...A dividend is usually declared quarterly after a company finalizes its income statement and dividends are paid either by check or in additional shares of ... ...

Top 12: What Are Dividends and How Do They Work? - The Motley FoolAuthor: fool.com - 153 Rating

Description: Why do companies pay dividends?. Dividend-paying companies. How are dividend amounts determined?. When are. dividends paid?. How are dividends taxed?. Related dividend stocks topics Owning dividend-paying stocks is a great way for the average investor to build long-term wealth. You can earn passive income from the dividends and benefit from capital appreciation. Historically, stocks that pay dividends have outperformed those that don't. By knowing how dividends work, you can benefit from th

Matching search results: Investors evaluate companies that pay dividends on the value of annual dividends paid relative to the price of the company's stock, which is known as the ...Investors evaluate companies that pay dividends on the value of annual dividends paid relative to the price of the company's stock, which is known as the ... ...

Top 13: Dividend Investing: How It Works and How to Get StartedAuthor: fool.com - 164 Rating

Description: How dividend stocks work. Examples of dividend stocks. Dividend yield and other key metrics. High yield isn't everything. How are dividends taxed?. Dividend investment strategies. Related Dividend Stocks Topics Dividend investing can be a great investment strategy. Dividend stocks have historically outperformed the S&P 500 with less volatility. That's because dividend stocks provide two sources of return: regular income from dividend payments and capital appreciation of the stock price. Thi

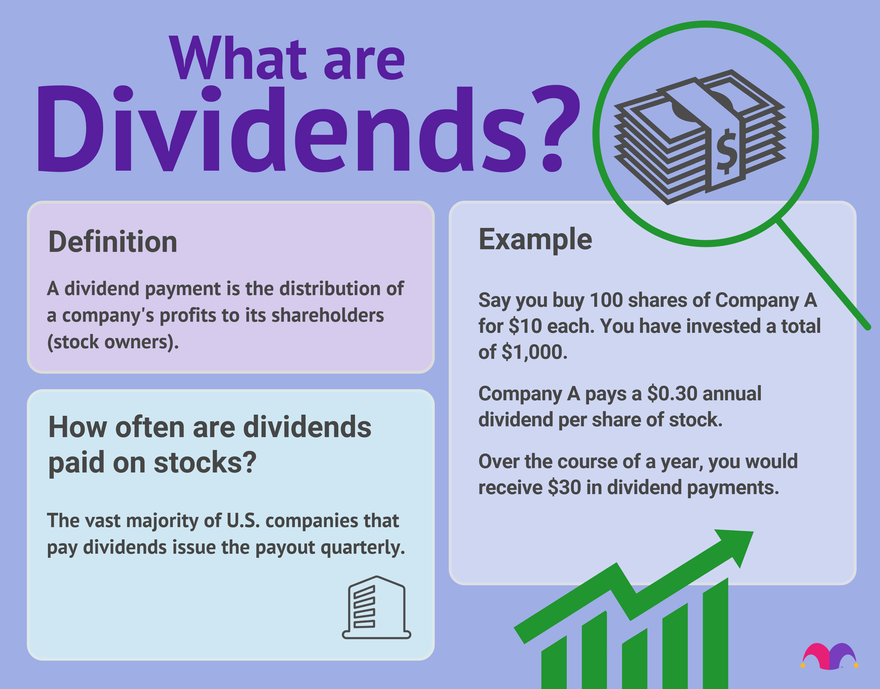

Matching search results: How dividend stocks work ... Let's look at an example. Say you buy 100 shares of a company for $10 each, and each share pays a dividend of $0.50 annually. If you ...How dividend stocks work ... Let's look at an example. Say you buy 100 shares of a company for $10 each, and each share pays a dividend of $0.50 annually. If you ... ...

Top 14: Dividend stocks: What they are and how to invest in them - BankrateAuthor: bankrate.com - 135 Rating

Description: How dividend stocks work. What are the Dividend Aristocrats?. How to invest in dividend stocks. Things to watch out for. 10 high-yielding stocks in. the Dow Jones Industrial Average. How are dividend stocks taxed?. Dividend stock investing strategies. Dividend stocks vs. dividend funds. High-yield mutual funds and ETFs. Dividend-appreciation funds and ETFs A dividend stock is a publicly traded company that regularly shares profits with shareholders through dividends. These companies tend to be b

Matching search results: Aug 31, 2022 · How dividend stocks work ... In order to collect dividends on a stock, you simply need to own shares in the company through a brokerage account or ...Aug 31, 2022 · How dividend stocks work ... In order to collect dividends on a stock, you simply need to own shares in the company through a brokerage account or ... ...

Top 15: Investing Basics: What Are Dividends - ForbesAuthor: forbes.com - 103 Rating

Description: Understanding Dividends. When Are Dividends Paid?. Which Stocks Pay Dividends?. Common Stock Dividends vs Preferred Stock Dividends. What Is Dividend Yield?. How Are Dividends Taxed?. How Do Dividend Reinvestment Plans Work?. Dividends for Mutual Funds and ETFs. How to Calculate Dividend Yield. How Are Qualified Dividends Taxed?. How Are Ordinary Dividends Taxed? Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evalua

Matching search results: Nov 11, 2021 · Dividends are how companies distribute their earnings to shareholders. When a company pays a dividend, each share of stock of the company you ...Nov 11, 2021 · Dividends are how companies distribute their earnings to shareholders. When a company pays a dividend, each share of stock of the company you ... ...

Top 16: All about Dividends: What they are & how they work - Public.comAuthor: public.com - 109 Rating

Description: What are stock dividends?. Why buy dividend stocks?. Why do some companies pay dividends and others do not?. How often are dividends paid out—and how do shareholders receive them?. Special dividends vs. regular dividends: Different types of dividends, compared. Should you automatically reinvest dividends?. Taxing stock dividends: What. to know. How to choose the right dividend stock to invest in. How to invest in dividend stocks on Public.com. Bottom line on dividend stocks. Frequently asked questions. Understanding the dividend payout ratio. Common dividend stock investing strategies. Can you use dividends to generate passive income?. How long do I have to hold a stock to get the dividend?. How do I take my dividends?. Can I get dividends from ETFs and mutual. funds?.

Matching search results: Stock: A stock dividend pays an investor with additional shares of stock. For example, if an investor owns 20 shares of a company that pays a 5% stock dividend, ...Stock: A stock dividend pays an investor with additional shares of stock. For example, if an investor owns 20 shares of a company that pays a 5% stock dividend, ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 moicapnhap Inc.